Protecting Your Claim. Maximizing Your Compensation.

Don’t face your insurance company alone. Let Triple B fight for your rightful claim.

About Triple B Public Adjusting

At Triple B Public Adjusting, we are dedicated to helping homeowners and business owners navigate the often overwhelming process of insurance claims. With years of experience and a commitment to advocacy, our mission is simple: to protect your rights and ensure you receive the full compensation you deserve.

We work directly for you—not the insurance company. From property damage assessments to claim negotiations, we handle every step with professionalism, transparency, and care. Whether you’re dealing with storm, fire, water, or other damages, you can count on Triple B to fight for your best interest.

Let us be your trusted partner when it matters most.

About Triple B Public Adjusting

At Triple B Public Adjusting, we specialize in managing insurance claims for residential and commercial property damage. Our goal is to take the stress off your shoulders and ensure you receive the maximum settlement possible. We handle the details, documentation, and negotiations—so you don’t have to.

Denied Claim?

Property Damage Claims

We assess and handle claims for all types of property damage due to storms, fire, water, or other disasters.

Storm & Wind Damage Claims

Expert evaluation and negotiation for damages caused by hurricanes, tornadoes, hail, and strong winds.

Water & Flood Damage Claims

Assistance with identifying, documenting, and claiming losses caused by leaks, floods, or burst pipes.

Fire & Smoke Damage Claims

Professional claim handling for fire and smoke-related incidents to ensure full recovery.

Roof Damage Claims

We inspect and manage roof-related claims, whether from weather, debris, or wear and tear.

Vandalism & Theft Claims

Support with securing documentation and filing claims for break-ins, theft, or property vandalism.

Hurricane Damage Claims

Hurricanes can cause devastating damage to homes and businesses—ripping off roofs, flooding interiors, and destroying property. At Triple B Public Adjusting, we specialize in handling complex hurricane insurance claims.

Hail Damage Claims

Hailstorms can cause serious and often hidden damage to roofs, siding, windows, and vehicles. Even small hail can lead to costly repairs if not properly documented and claimed.

Mold Damage Claims

We help identify mold-related damage and ensure it’s properly documented and covered by your insurance policy.

Why Choose Triple B Public Adjusting?

Client-Focused Advocacy

We work exclusively for you, not the insurance company. Your best interests are always our top priority.

Expert Claim Handling

With years of experience, we understand how to properly assess damages, prepare documentation, and negotiate for the highest possible settlement.

Fast & Reliable Support

We respond quickly, act professionally, and keep you updated every step of the way—so you’re never left in the dark.

Detailed Inspections & Documentation

We perform thorough property inspections and provide accurate, detailed reports to strengthen your claim and avoid delays or denials.

Submit Your Claim

Let Us Handle the Stress — Get the Compensation You Deserve

Fill out the form below to get started. Our team will review your information and contact you quickly to begin the claims process. No pressure, no obligation—just experienced support on your side.

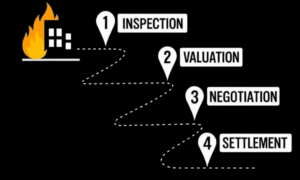

Our Proven 4-Step Claims Process

Inspection

We begin with a detailed, on-site inspection of your property to document all visible and hidden damage. Our trained experts ensure nothing is overlooked.

Valuation

Using industry-standard tools and pricing software, we create an accurate valuation of your losses—so you know exactly what your claim is worth.

Negotiation

We represent you and negotiate directly with the insurance company to secure the maximum compensation you deserve. We know their tactics—and how to counter them.

Settlement

Once a fair settlement is reached, we guide you through the final steps to quickly secure your payout, so you can begin rebuilding with peace of mind.

See the Difference We Make

From Damage to Resolution — Explore real cases where Triple B Public Adjusting helped turn losses into fair settlements.

Get the Help You Deserve

Ready to start your claim or have question? Contact Triple B Public Adjusting — your trusted advocate in insurance claims.

What is a Public Adjuster?

A public adjuster is a state-licensed insurance professional specializing in managing every aspect of an insurance claim on behalf of the policyholder. Unlike your insurance company’s adjuster, who works for the insurance company, a public adjuster represents you and your interests. Public adjusters are individually-licensed and work as independent contractors. 46 states in America have specific licensing requirements for public adjusters. In order to call yourself a licensed public adjuster in most states, you need to meet strict requirements. Alabama, Alaska, Arkansas, South Dakota, and Wisconsin do not have regulatory schemes for public adjusters.

uster in most states, you need to meet strict requirements. Alabama, Alaska, Arkansas, South Dakota, and Wisconsin do not have regulatory schemes for public adjusters.

What do Public Adjusters Do?

Generally speaking, a public adjuster manages every aspect of your claim from beginning to end. They investigate, inspect, appraise, and adjust the insurance claim. Unlike your insurance company’s adjuster, however, a public adjuster works for you. The goal is to maximize the amount of compensation you receive from your insurance company. A public adjuster will ensure your claim is handled efficiently and achieves a fair outcome. The public adjuster will also negotiate with the insurance company on your behalf.

What should I look for in a Public Adjuster?

You should look for the same qualities you would look for in any other professional, which includes experience and proven performance. Your Public Adjuster must be licensed and bonded. Your chosen Public Adjuster should also utilize its own staff of adjusters, appraisers and other professionals to assist him or her in maximizing the benefits you are entitled to receive after a claim. The Public Adjuster you choose should be aware of your needs and responsive to your concerns.

Do I need a Public Adjuster?

If you’ve experienced a disaster at your property, then you may be considering hiring a public adjuster. Public adjusters are licensed & bonded, experienced insurance professionals. We can help you avoid making mistakes on your insurance claim. We keep your insurance company honest. Every day we get calls from clients who were underserved by their insurance. Just last month we helped serve a family who originally received just under 6k from their insurance. After reviewing the claim and going through our process we finished with 50k for our client. It’s up to you to decide if you need a public adjuster.

Why should I hire Triple B Public Adjusting?

We bring expertise, negotiation skills, and detailed inspections to ensure your claim is properly handled. Most importantly, we fight for what you’re truly owed, not what the insurance company wants to pay.

Can I hire you even if I’ve already filed a claim?

Yes! Even if your claim is already in progress—or was denied or underpaid—we can step in to review, reopen, or negotiate on your behalf.